Table of contents

- Comparing Gong to other AI sales coaching tools: A practical comparison

- What reviewers consistently praise about Gong

- Common criticisms and challenges with Gong

- The rise of new tools built for specific use cases

- Shifting to budget-friendly tools for focused outcomes

- Choosing the right AI sales coaching tool for your team

- Conclusion: the new era of targeted sales enablement

Comparing Gong to other AI sales coaching tools: A practical comparison

The landscape of sales enablement is undergoing a profound transformation. For years, one name has dominated the field of revenue intelligence, setting the gold standard for conversation analytics and forecasting: Gong. However, the market has rapidly evolved, introducing a new generation of specialized, often more budget-friendly AI sales coaching tools built for specific outcomes, namely real-time enablement.

For sales managers, RevOps leaders, and VPs of sales, the decision is no longer about whether to adopt AI, but which platform delivers the highest return on investment (ROI) for their unique sales motion. This article provides a practical comparison of the established leader, Gong, and the emerging wave of specialized AI platforms, exploring how this technological shift is reshaping the way high-performing teams coach, analyze, and win.

What reviewers consistently praise about Gong

Gong earned its position as a market leader by pioneering the revenue intelligence category. Its platform offers enterprise-grade conversation analytics and data-driven insights that empower sales leadership to make strategic decisions.

1. Unmatched data and foundational strength

Gong’s primary strength lies in its scale. The company’s AI models are trained on the industry’s largest dataset of customer interactions, totaling over three billion calls and meetings [1]. This massive foundation of data enables highly detailed conversation analytics and insights that few competitors can match. This data advantage translates directly to business results: sales organizations that utilize one or more of Gong’s AI features have achieved higher deal win rates, leading to revenue success up to 35% higher for the utilizing teams [2]. Even following challenging economic years, organizations using tools like Gong reported an average revenue growth of 19%, up from 11% year-over-year [3].

2. Comprehensive revenue intelligence and forecasting

For complex, large-scale enterprise sales, Gong provides a strong baseline for critical sales decisions. Expert analysts recognize Gong’s core strengths, which include premier AI forecasting, robust pipeline management, and detailed deal risk assessment [4]. Its feature set extends well beyond simple transcription, offering advanced capabilities like the “Ask Anything” deal query tool, which customers validate for its accuracy in providing unique buyer and seller insights [5]. This holistic approach is why independent research firms, such as Forrester, have named Gong a leader in revenue orchestration, giving it the highest score of any vendor in “Current Offering,” topping criteria like innovation, AI/automation, analytics insights, and user experience in their Q3 2024 wave report [5].

3. High user adoption and experience

Despite its complexity, users frequently praise Gong’s intuitive user interface (UI) and overall ease of use. The platform is widely adopted by more than 4,800 companies worldwide [5]. On leading review sites, Gong maintains high user ratings, including 4.7/5 stars on G2 from thousands of reviews [6]. Reviewers often cite the ability to quickly revisit a call or ask the AI for summaries as a key feature that simplifies client meeting preparation [7, 6]. Overall, users report that Gong provides “excellent visibility into conversations,” with very accurate transcription, intuitive analytics dashboards, and seamless integrations with popular sales tools [6].

Common criticisms and challenges with Gong

While Gong’s capabilities are robust, its enterprise-focused nature often introduces significant friction for teams that do not require its full revenue intelligence suite or those operating under budget constraints.

1. The real-time gap: post-call only analysis

The most critical operational deficiency cited by sales leaders is Gong’s exclusive focus on post-call analysis. The analysis is “entirely post-call, there is no real-time coaching or guidance during a live conversation“. This limitation means that issues, poor habits, or critical sales moments are only flagged after the fact. While the insights are valuable for future training, the platform provides no live, in-call guidance, thus limiting its immediate impact on a sales representative’s live behavior and overall deal outcome [8, 9]. The inability to offer real-time assistance prevents the platform from addressing the critical gap between training and execution, where the most coaching value can often be found.

2. High cost and opaque pricing model

For growing businesses, the cost of implementing a full revenue intelligence suite can be a significant barrier. Gong operates with a complex, opaque pricing model that includes a substantial, non-negotiable platform fee, which often exceeds $5,000 [10]. This high barrier to entry disproportionately affects startups and most small to midsize businesses (SMBs). Beyond the platform fee, the estimated annual per-user cost for Gong is high, typically falling between $1,360 and $1,600 per user [11]. Reviewers frequently cite this high cost and opaque pricing as major downsides [12].

3. Implementation and onboarding friction

The time-to-value (TTV) for legacy, enterprise platforms can be extensive. Implementation timelines for complex deployments of platforms like Gong are lengthy, often spanning eight to twelve months, which can significantly delay the realization of ROI [13]. Reviewers frequently complain about time-consuming onboarding, a steep learning curve, and messy customer relationship management (CRM) setup [12]. For example, integrating Gong with Zoom, Slack, and Salesforce has been reported to take three to four weeks of dedicated setup [8]. Furthermore, achieving accuracy with features like smart trackers, which are built on older technology, requires extensive manual training, sometimes demanding sales teams input 50 to 100 example sentences per tracker [12].

The rise of new tools built for specific use cases

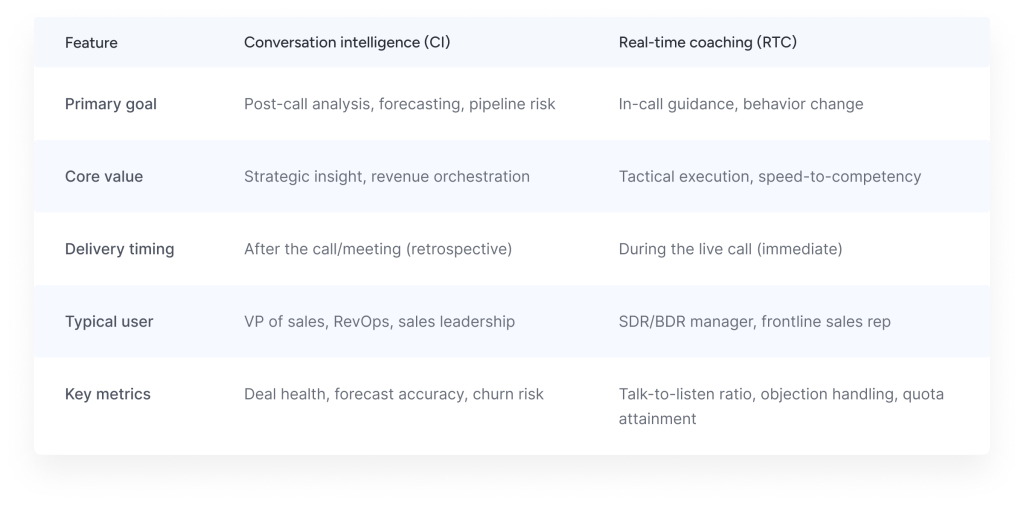

The AI sales coaching market is segmenting, moving away from a single, monolithic platform towards specialized tools tailored for specific sales motions and desired outcomes. This segmentation has solidified into two primary categories:

Conversation intelligence (CI) tools

This category, championed by Gong, includes competitors like Chorus (ZoomInfo), Salesloft, Clari, and Mindtickle [14, 15]. These platforms focus primarily on post-call analytics, providing deep insights into buyer behavior, compliance, and training opportunities after the conversation has concluded.

Real-time coaching (RTC) tools

This emerging category focuses on live interaction guidance [14]. Real-time coaching (RTC) is defined as providing instant guidance and feedback to sales representatives during a live sales interaction, bridging the critical gap between training and execution [16]. This shift in focus is driving measurable improvements:

- Specialized real-time coaching applications, such as Cluely, HeyNomi, and Salesken.ai, deliver immediate in-call suggestions [17].

- Newer RTC platforms are demonstrating technological leadership. For instance, comparing core feature ratings, Salesken.ai is rated higher than Gong in call analysis (9.6 vs. 9.1) and artificial intelligence (9.8 vs. 8.7) on G2, indicating a shift in technological leadership towards specialized enablement [18].

This table compares Conversation Intelligence (CI) and Real-time Coaching (RTC) tools. CI’s primary goal is post-call analysis and strategic revenue orchestration for sales leadership, focusing on metrics like deal health and forecast accuracy. RTC provides in-call guidance for tactical execution and immediate behavior change for frontline reps and managers, measuring talk-to-listen ratio and quota attainment

Shifting to budget-friendly tools for focused outcomes

The specialized focus on real-time coaching is enabling a new class of platforms to offer superior value and performance at a fraction of the cost, making advanced AI capabilities accessible to teams of all sizes, especially SMBs.

The impact of live coaching

Focusing on the immediate, measurable impact of live guidance makes a strong business case for specialized RTC tools:

- Live call coaching yields a 30% increase in quota attainment, moving teams from 16% attainment under traditional coaching to 46% [19].

- Companies that implement live call coaching see a 40% improvement in win rates (28% compared to 20% for traditional coaching) [19].

- RTC platforms drastically reduce the ramp time for new representatives by up to 50%, moving from a traditional six months down to three months, saving companies an estimated $50,000 to $100,000 per representative annually through improved retention and faster productivity [19].

Accessible AI and competitive pricing

The fundamental shift in the market is driven by economics. While legacy enterprise platforms often cost upwards of $500 per user per month, the new generation of AI-first platforms can claim up to an 80% lower total cost of ownership [17]. Generative AI in sales yields approximately 3.7 times ROI on investment, and 91% of SMBs using AI report revenue growth [17].

Teams are increasingly adopting leaner solutions tailored for their exact needs. Examples of low-cost solutions include Otter.ai business for transcription at about $20 per user per month, and Cluely’s live-coaching plan at about $20 per user, prices far below traditional enterprise tool fees [17]. Even budget alternative Grain is approximately 10 times cheaper than Gong and operates on a transparent, scalable model with zero platform subscription fees or minimum spend [20].

Platforms like Outscale.ai are leading the charge in this budget-conscious segment. They deliver focused, real-time coaching and feedback at accessible price points, catering specifically to teams prioritizing in-the-moment enablement and efficiency. By focusing on essential, high-impact features like contextual coaching during the call and immediate feedback, specialized platforms offer a transparent, scalable model that aligns well with the 80% of B2B buyers who favor usage-based, pay-as-you-go pricing for SaaS [17]. Sales leaders managing teams of less than 50 representatives should prioritize tools in the $0–$99 per user per month range to avoid steep, long-term contracts [17].

Choosing the right AI sales coaching tool for your team

Selecting the right platform is not about finding the tool with the most features, but the one that aligns perfectly with your team’s structure, sales motion, and budget. Use the following four-step framework to guide your decision:

Step 1: Confirm CRM integration and data flow

The AI tool must provide seamless, bi-directional synchronization with your existing CRM, such as Salesforce or HubSpot [17]. Without this integrated data flow, conversation insights cannot easily inform pipeline analytics or be accurately applied to deal health scores, making the investment largely redundant for RevOps teams.

Step 2: Match to team size and motion

Scale your solution appropriately. For small teams (fewer than 50 representatives), prioritize simple, affordable tools that can be set up quickly and fall in the $0–$99 per user per month range [17]. Mid-market teams (50–200 representatives) often benefit from unified AI platforms that bundle conversation analytics with forecasting capabilities to avoid vendor overload and integration complexity. Large organizations (more than 200 representatives) have enterprise requirements. They must prioritize vendors that guarantee fast deployment (in weeks, not months) and can meet robust compliance and security standards like SOC2 and GDPR [17].

Step 3: Align features to your sales motion

Different sales roles require different AI capabilities [17]:

- High-volume SDR/BDR teams: These roles benefit most from tools offering top-tier transcription accuracy, automated talk-to-listen ratio analytics, and basic sentiment scoring to monitor script adherence and engagement quality. Their primary need is efficiency and foundational coaching.

- Complex enterprise deal teams: These teams need advanced pipeline analytics that go beyond simple scoring. They require deep conversational insights, deal health checks, and advanced risk assessment to accurately forecast and manage churn risk. Here, a full revenue intelligence platform or a highly specialized conversation intelligence tool may be necessary.

- Actionability: Are the insights presented in a way that allows managers to create specific, measurable coaching actions? Remember that sales teams typically need 3–6 months of call data to train reliable AI coaching models and establish an accurate performance baseline [9].

Step 4: Evaluate time-to-value (TTV)

Consider how quickly the tool can impact your team. If your primary goal is to immediately accelerate new rep ramp time or improve the performance of live calls, a dedicated real-time coaching platform will offer a faster TTV. If your goal is long-term strategic forecasting and historical pipeline analysis, a conversation intelligence platform, despite its longer implementation, may be the appropriate choice.

Conclusion: the new era of targeted sales enablement

The conversation has moved beyond Gong versus its closest traditional competitors. The market is maturing, giving sales leaders unprecedented choice. While Gong remains the definitive leader for strategic, large-scale revenue intelligence, its post-call-only analysis and high barrier to entry have created a massive opportunity for budget-friendly, specialized AI sales coaching tools.

By clearly segmenting your needs between strategic post-call analysis and tactical in-the-moment coaching, you can select a platform, whether it is a market-defining CI tool or an agile, RTC solution like Outscale.ai, that delivers targeted, high-impact enablement, ensuring every dollar spent directly contributes to increased quota attainment and accelerated revenue growth.

Sources:

[1] https://www.gong.io/press/gong-named-best-ai-based-solution-for-sales-in-2024-ai-breakthrough-awards/

[2] https://www.gong.io/press/ai-delivers-up-to-35-higher-revenue-success-according-to-analysis-of-more-than-one-million-sales-opportunities/

[3] https://www.gong.io/blog/the-best-sales-insights-of-2024

[4] https://forecastio.ai/blog/clari-vs-gong

[5] https://www.gong.io/press/independent-research-firm-names-gong-a-leader-in-revenue-orchestration-platforms/

[6] https://www.g2.com/products/gong/reviews

[7] https://www.gartner.com/reviews/market/revenue-intelligence/vendor/gong/product/gong/likes-dislikes/

[8] https://tldv.io/blog/gong-review

[9] https://www.lindy.ai/blog/gong-review

[10] https://www.claap.io/blog/gong-pricing

[11] https://sales.hatrio.com/blog/9-best-ai-sales-coaching-tools-2025/

[12] https://www.oliv.ai/blog/what-are-gong-smart-trackers

[13] https://www.oliv.ai/blog/gong-vs-oliv

[14] https://globibo.com/ct/ai-sales-coaching-with-conversation-intelligence/

[15] https://monday.com/blog/crm-and-sales/conversation-intelligence-software/

[16] https://www.getaccept.com/blog/real-time-sales-coaching-transforming-your-sales-teams-performance

[17] https://outscale.ai/2025/10/31/budget-friendly-tools-for-ai-sales-coaching/

[18] https://www.g2.com/compare/gong-vs-salesken

[19] https://www.kixie.com/sales-blog/sales-coaching-statistics-and-the-impact-of-live-coaching-on-quota-attainment/

[20] https://grain.com/blog/gong-alternatives