Table of contents

- The RevOps guide: Comparing AI sales coaching tool pricing in 2025

- Overview of pricing tiers in AI sales coaching tools

- Free and flexible options for emerging teams

- What drives cost variation: features, users, and integrations

- Emerging tools and the shift to flexible, use-case-based pricing

- Hidden and one-time costs: implementation, data migration, and scaling up

- How to benchmark pricing against value: ROI and fit

- Conclusion: Strategic investment, not just expense

The RevOps guide: Comparing AI sales coaching tool pricing in 2025

The shift to AI-driven sales enablement is no longer optional. For sales managers, directors, and RevOps leaders, artificial intelligence represents the single greatest lever to boost rep performance, shorten ramp times, and ensure consistent messaging across the GTM function. As the market matures, the competitive landscape of AI sales coaching tools has become a key strategic consideration.

However, the question often shifts from if you should adopt AI coaching to how much it will actually cost.

Choosing the right platform-one that delivers maximum impact without budget overages-requires a clear understanding of the evolving pricing models, hidden fees, and the true drivers of cost. This guide provides Sales Ops, BDR managers, and VPs of sales with an actionable framework for comparing the pricing of the best AI sales coaching tools in 2025, ensuring your investment is perfectly aligned with your team’s size, maturity, and revenue goals.

Overview of pricing tiers in AI sales coaching tools

Most established AI sales coaching platforms utilize a tiered structure designed to match features, support, and volume limits to a company’s size and complexity. Understanding these tiers is the first step in aligning platform spending with organizational scale.

The three standard tiers

- Entry-level or starter plans: These are often geared toward small businesses or proof-of-concept projects, typically offering limited features such as basic call recording, transcription, and minimal analytics. Research shows that entry-level plans for established platforms generally range from $70–$100 per user per month [1]. Crucially, these plans often exclude essential functions like unlimited transcription storage or advanced predictive analytics, making them less viable for high-volume sales teams.

- Mid-market to growth plans: Tailored for teams of 50 to 200 representatives, these plans unlock core features necessary for structured coaching, including sentiment analysis, conversation scoring, and deeper CRM integration. The cost is significantly higher, driven by the demand for comprehensive features, but the value is in the ability to scale consistent coaching practices across multiple teams.

- Enterprise packages: These plans are designed for large organizations, offering the complete suite of capabilities, including sophisticated features like multi-CRM synchronization, custom compliance and security controls, dedicated support, and custom report builders. For full-featured platforms, costs in this segment often rise to $120 or more per user per month [2].

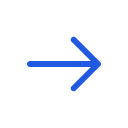

Typical pricing structure comparison

The table below illustrates the typical features and pricing expectations across the three standard tiers for established AI sales coaching platforms:

This table summarizes a typical three-tier pricing structure for sales conversation intelligence platforms. The Entry-level/starter tier ($70-$100 per user/month) targets small teams and pilots, offering basic call recording and essential CRM sync. The Mid-market/growth tier ($100-$120+) is for growing teams, adding conversation scoring, sentiment analysis, and core coaching workflows. The Enterprise tier ($120+, custom pricing) is designed for large organizations, providing advanced features like real-time coaching, predictive analytics, custom reports, and dedicated compliance and support.

Free and flexible options for emerging teams

While enterprise pricing dominates the conversation, the accessibility of AI coaching is expanding through freemium and highly flexible models offered by emerging players. Smaller tools are making it possible for early-stage teams to experiment with AI coaching before committing to significant expenditure.

For example, some platforms offer a limited-use free tier or low-cost paid plans, allowing organizations to start small. Maximus.ai, for instance, offers a basic plan that includes call recording for a low per-rep per-month cost for a specific number of calls [3], [4], [5]. This accessibility means that sales leaders can choose a starting point that matches their current team’s budget and engagement level.

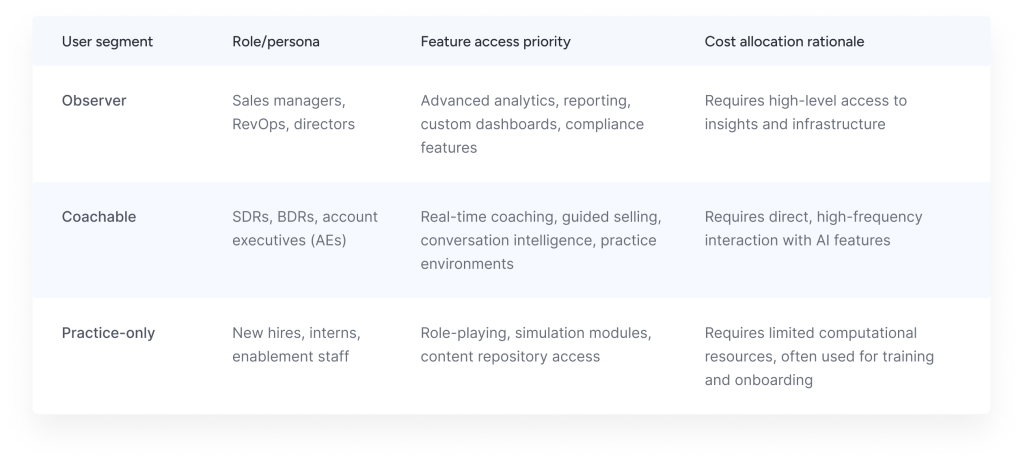

A common pricing framework

To better allocate licenses and manage spend, RevOps professionals should recognize that not all users require the same access level. A common pricing framework segments users based on their functional need, which helps reduce unnecessary license fees [6]:

This table outlines a pricing framework based on three user segments: Observer, Coachable, and Practice-only. The Observer segment (managers, directors) prioritizes advanced analytics and reporting, justifying cost through access to high-level insights. The Coachable segment (reps) requires real-time coaching and AI-driven features due to high-frequency interaction. The Practice-only segment (new hires, interns) requires limited computational resources for role-playing and training modules.

By segmenting licenses this way, sales organizations can avoid paying full price for users who only require limited, observational, or training-based access to the platform.

What drives cost variation: features, users, and integrations

In the AI sales coaching space, the price tag is ultimately a reflection of computational intensity and functional complexity. While the number of active users is a primary factor, specific features and integration requirements can multiply the per-seat cost.

1. The premium on real-time coaching and advanced analytics

The most significant cost drivers are the features that rely on continuous, low-latency processing of data.

- Real-time guidance: Delivering in-the-moment, contextual coaching to a sales representative during a live call or meeting is computationally expensive. This functionality requires immediate processing of audio, sentiment, and compliance checks. Research indicates that real-time AI features can increase the per-seat cost by 25–40% compared to standard post-call analysis [7].

- Predictive vs. descriptive analytics: Descriptive analytics simply tells you what happened (e.g., talk-to-listen ratio). Advanced predictive analytics tells you what will happen (e.g., which deals are at risk, which reps are likely to churn) and why. Predictive analytics, which utilizes complex machine learning models, can make platforms up to 1.8 times more expensive than those offering only standard descriptive insights [8]. Sales Ops and RevOps must decide if the added predictive layer justifies the increase in investment.

2. Integration complexity and API usage

In modern sales stacks, AI coaching tools must integrate seamlessly with CRMs, dialers, and communication platforms like Zoom or Microsoft Teams. The depth and complexity of these integrations significantly influence the total cost of ownership.

- High-volume syncs: Integration is a major cost factor. Complex API usage for high-volume, real-time synchronization with CRMs (like Salesforce or HubSpot) or dialer systems can increase the overall cost, often exceeding the base license fees [9].

- Custom setups: Organizations requiring complex single sign-on (SSO) configurations, custom data mapping, or compliance-driven setups will almost always incur professional services fees on top of the base subscription. As one expert commentary suggests, integration complexity often costs more than the number of seats alone [10].

- Team size scaling: Pricing may also scale based on overall team size, rather than just active users. For instance, some platforms utilize a platform fee that increases with the total number of representatives, in addition to charging per recorded user [11].

Emerging tools and the shift to flexible, use-case-based pricing

The landscape of AI sales coaching is rapidly evolving, leading to new pricing models that better align cost with actual usage and value. A new generation of tools is moving away from the traditional, rigid per-seat licensing common among legacy vendors.

The rise of usage-based and consumption models

For growing GTM teams, paying for unused licenses is a budget drain. Usage-based models solve this by directly linking the cost to the volume of coaching delivered or consumed.

- Paying for output, not seats: This approach-often called value-metric pricing-links cost to specific, measurable outputs such as ‘Coached calls per month’ or ‘Simulation minutes used’ [12]. This alignment ensures that expenditure directly reflects team engagement and usage, eliminating waste from shelfware licenses.

- Credit systems: Some platforms are adopting credit or token-based systems. For example, Skwill.ai sells AI coaching credits that allow teams to pay specifically for active coaching usage rather than maintaining costly licenses for every single employee [13], [14]. Outscale.ai, a next-generation platform, also focuses on providing adaptive, contextual coaching designed to be highly efficient and budget-friendly for scaling teams. These platforms deliver highly specific, real-time, in-the-moment coaching and contextual feedback that aligns well with the need for immediate, actionable guidance, offering a compelling alternative to higher-cost, full-suite platforms.

- Higher net dollar retention (NDR): Companies adopting consumption-based or usage-based pricing often report 15–20% higher net dollar retention [15]. This metric suggests that these models are easier for customers to adopt and scale, reinforcing the idea that they align better with perceived value.

This trend toward unbundling pricing is putting pressure on large enterprise vendors [16]. Smaller competitors are demonstrating that teams benefit from having the flexibility to pay only for the advanced features they actively use, making adaptive pricing strategies highly attractive for organizations seeking next-generation AI coaching without committing to large upfront costs.

Hidden and one-time costs: implementation, data migration, and scaling up

When budgeting for a new AI sales coaching platform, Sales Ops and RevOps must look beyond the monthly subscription fee to calculate the true total cost of ownership (TCO). Ignoring one-time and recurring non-subscription expenses is the fastest way to derail a budget.

The total cost of ownership (TCO) framework

The TCO should include both the recurring licensing fees and several categories of one-time and ongoing non-subscription costs [17]:

- Implementation and professional services: Getting a complex AI platform integrated with a sophisticated sales stack is rarely plug-and-play. Implementation services for enterprise tools can add a significant 15–30% to the first-year subscription cost [18]. This includes setting up roles, configuring workflows, and ensuring accurate data flow.

- Data migration: Migrating historical call data, custom scorecards, and coaching playbooks from previous systems (or manual storage) to the new platform can involve substantial fees. RevOps teams need to account for large-scale data migration services and potential data egress costs from legacy vendors [19], [20].

- User training and enablement: While the platform itself is a coaching tool, end-user training—both for managers (observer segment) and representatives (coachable segment)—is a necessary, often overlooked, expense. This includes platform training, content creation for new coaching modules, and ongoing internal support resources.

- API overages: If your team integrates the coaching platform with other high-volume systems, be wary of API call limits. Exceeding contracted limits for real-time CRM or dialer synchronization can lead to recurring API overage charges that were not factored into the initial budget [18], [19], [20].

- Scaling costs: Ensure the contract clearly defines the pricing mechanism for future seat additions. Rapidly adding hundreds of seats mid-year can lead to less favorable pricing tiers or unexpected platform fees if the original agreement was not structured to accommodate hyper-growth.

How to benchmark pricing against value: ROI and fit

Evaluating the investment in AI sales coaching cannot be done in a vacuum; the price must be benchmarked against the expected, measurable returns. The core task for sales leadership is to identify tools that deliver the right balance of investment and business value.

The value-to-cost framework

Instead of merely comparing monthly fees, sales leaders should use a Value-to-Cost Framework [21]:

Value-to-Cost Ratio = Expected ROI (e.g., deal size increase, ramp-time reduction/Total Cost of Ownership

A key calculation within this framework is comparing the cost per ‘Coaching moment delivered’ by the AI platform against the cost of a manual 1:1 coaching session (which must factor in the manager’s salary and time). When an AI tool can automate and scale contextual coaching for a fraction of the manual cost, its price point becomes highly justified.

Quantifying the return on investment (ROI)

The strategic investment in AI coaching delivers several measurable returns that quickly justify the expenditure. Structured adoption of these platforms drives quantitative performance improvements across the sales funnel [22], [23], [24], [25], [26]:

- Ramp-up time: A structured AI coaching implementation can reduce new rep ramp-up time by 12–45%, directly cutting operational costs.

- Win rates and deal size: Platforms consistently boost win rates by an average of 25–29% and increase average deal size by approximately 7%.

- Pipeline efficiency: The impact on the deal cycle is also notable, with coaching tools helping to shorten deal cycles by around 30%.

- Qualified appointments: BDR and SDR teams benefit from up to a 22% increase in qualified appointments by leveraging real-time guidance on qualification scripts and messaging.

These results underscore a crucial principle: a slightly more expensive tool that delivers 45% faster rep ramp-up is often a far better value than a cheaper tool that only yields 15% improvement.

Fit for purpose and team maturity

Finally, pricing must be evaluated against the specific needs of the sales organization. As expert commentary suggests, a high-cost enterprise platform is often overpriced if the team is only using a fraction of its features [27].

For smaller or rapidly scaling teams, achieving high immediate ROI often means adopting specialized tools with flexible or usage-based plans. These tools, designed for agility, allow organizations to target specific pain points—like call compliance or discovery skills—and pay for the value derived, rather than the overhead of a massive, feature-bloated license. The goal is to maximize the coaching impact per dollar spent.

Conclusion: Strategic investment, not just expense

The pricing of AI sales coaching tools in 2025 is moving away from simple per-seat licensing toward complex, value-driven models. For RevOps and sales leadership, the successful budget requires strategic foresight.

To choose the optimal solution, you must:

- Differentiate: Understand the cost drivers, particularly the premium associated with real-time contextual coaching and predictive analytics.

- Calculate TCO: Include the hidden costs of implementation, data migration, and potential API overages in your budget projections.

- Prioritize value: Benchmark the subscription cost against the expected ROI, such as faster rep ramp-up and higher win rates, using the Value-to-Cost Framework.

- Embrace flexibility: Explore emerging usage-based platforms, like Outscale.ai, that offer adaptive and budget-friendly models, allowing you to pay for active coaching value rather than static licenses.

By adopting this comprehensive approach, you ensure your investment in AI sales coaching is not just a necessary expense, but a strategic lever that drives predictable, measurable revenue growth across your entire GTM team.

Sources:

[1] G2 - Sales coaching software: https://www.g2.com/categories/sales-coaching-software

[2] Momentum.io - AI sales coaching guide: https://www.momentum.io/blog/top-ai-driven-sales-coaching-platforms-2025-buyers-guide-for-gtm-teams

[3] Maximus.ai pricing: https://usemaximus.com/pricing-2

[4] Spiky.ai pricing: https://spiky.ai/en/pricing

[5] Cluely pricing: https://cluely.com/pricing

[6] Forrester research - future of sales enablement: https://www.forrester.com/report/The-Future-Of-Sales-Enablement-AI-Driven

[7] Zendesk - 2024 AI sales trends report: https://www.zendesk.com/blog/2024-ai-sales-trends-report/

[8] TechCrunch - SaaS pricing in AI era: https://techcrunch.com/2024/03/saas-pricing-models-in-ai-era/

[9] Sales hacker - RevOps challenges: https://www.saleshacker.com/revops-challenges-2024/

[10] HoneHQ - AI coaching platforms guide: https://honehq.com/resources/blog/10-best-ai-coaching-platforms-employee-development-2025/

[11] Salesken.ai pricing: https://www.salesken.ai/pricing

[12] A16z - rules of SaaS pricing in the AI era: https://www.a16z.com/2024/01/25/the-new-rules-of-saas-pricing-in-the-ai-era/

[13] Skwill.ai pricing: https://skwill.ai/pricing

[14] Outscale.ai platform information: https://outscale.ai/

[15] Forbes business council - usage-based pricing shift: https://www.forbes.com/sites/forbesbusinesscouncil/2024/02/09/the-shift-to-usage-based-pricing-in-b2b-saas/

[16] SalesforceBen - AI in sales trends: https://www.salesforceben.com/ai-in-sales-2024-trends/

[17] HoneHQ - TCO framework: https://honehq.com/resources/blog/10-best-ai-coaching-platforms-employee-development-2025/

[18] Toptal - SaaS implementation costs: https://www.toptal.com/finance/saas-pricing-model/implementation-costs

[19] RevOps today - integrating sales AI budgeting: https://revopstoday.com/integrating-sales-ai-2024-budgeting/

[20] Google cloud - data egress and migration costs: https://cloud.google.com/blog/topics/developers-practitioners/understanding-saas-data-egress-and-migration-costs

[21] Sales management association - ROI framework: https://www.sales-management-association.com/research/ai-sales-roi-frameworks-2024

[22] McKinsey - power of AI in sales coaching: https://www.mckinsey.com/capabilities/operations/our-insights/the-power-of-ai-in-sales-coaching

[23] HBR - how AI is redefining sales performance: https://hbr.org/2024/04/how-ai-is-redefining-sales-performance

[24] SiriusDecisions - state of the BDR: https://www.siriusdecisions.com/insights/state-of-the-bdr-2024

[25] Retorio - top AI sales coaching software: https://www.retorio.com/blog/top-ai-sales-coaching-software-2025

[26] Outscale.ai - AI sales coaching: https://outscale.ai/ai-sales-coaching/

[27] Gainsight predictions: https://www.gainsight.com/blog/2024-saas-customer-success-predictions/